By Isma Ahmed

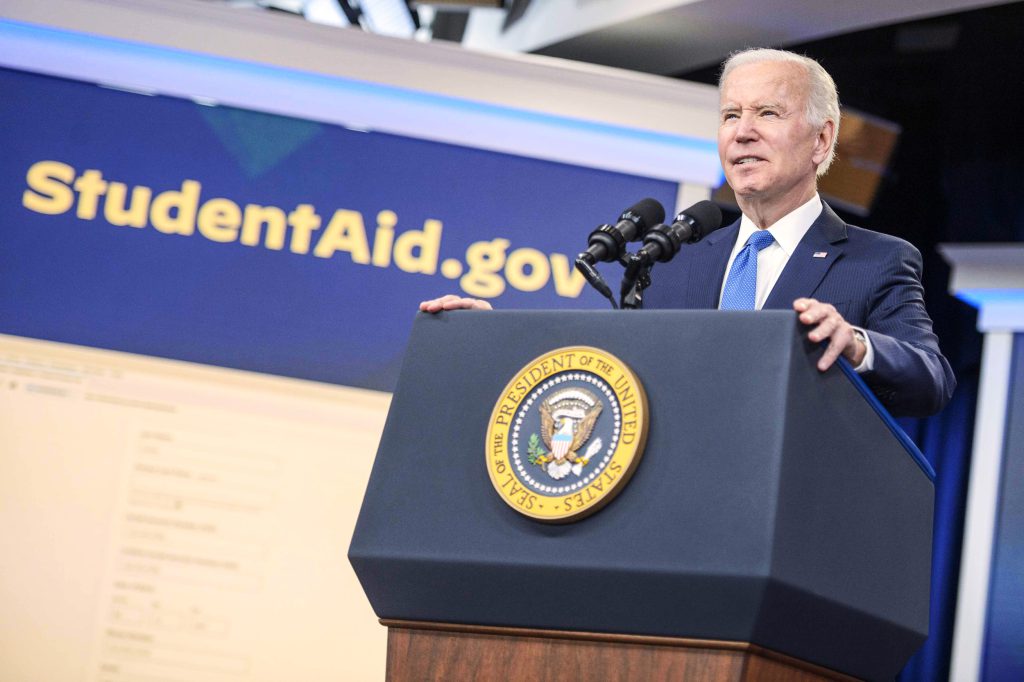

On August 24, 2022, President Biden announced the start of a Student Loan Relief Program for borrowers nationwide. According to the White House, the loan relief program plans to help students from lower and middle-class families and those eligible for Pell Grants to support their education. Up to $20,000 of student debt can be forgiven for those eligible. The White House states that the relief program forms three parts, each serving to tackle student debt.

The first part of the Student Loan Relief Program aims to provide Targeted Debt Relief. As stated by The White House, this part plans “To address the financial harms of the pandemic for low- and middle-income borrowers and avoid defaults as loan repayment restarts.” Independent borrowers’ eligibility will depend on their income, which has to be less than $125,000 (less than $250,000 if they’re married). The individual must also have received a Pell Grant (household income is less than $60,000) to get up to $20,000 of debt relief. If a borrower’s income qualifies but has not received a Pell Grant, the debt relief will only go as far as $10,000. Dependent borrowers “…will be eligible for relief based on parental income, rather than their own income.”

The second part of the relief program works to make the student loan system more manageable for borrowers. The relief program plans to fix existing loan repayment to lower monthly payments. It is for those individuals who are in the process of repaying their loans. The White House states, “For undergraduate loans, cut in half the amount that borrowers have to pay each month from 10% to 5% of discretionary income”. In addition, the amount of income considered ‘non-discretionary’ will be raised to protect it from repayment. Loan balances will be forgiven in ten years of compensation if the balance is less than $12,000 rather than initially in twenty years. No borrower’s loan balance is intended to grow with interest as long as the individual keeps up with the monthly repayments. These changes “would simplify loan repayment and deliver significant savings to low- and middle-income borrowers” claims The White House.

The last part of the Student Loan Relief Program intends to protect borrowers and taxpayers from steep increases in college costs. The White House claims it will take further actions to “hold career programs accountable for leaving their graduates with mountains of debt they cannot repay” and hold colleges accountable for contributing to the debt crisis with their poorly designed programs. The Loan Forgiveness Program can avert the student debt crisis for future generations.

Although the Student Loan Relief Program may be a breath of fresh air for indebted students, the same cannot be for the government. As President Biden has brought forth his plan to cancel debt for millions of students, there is a divide among the Democrats over this executive order. The New York Times, Biden’s Student Loan Forgiveness Plan Divides Democrats, states there have been split reactions to the plan. The New York Times writes that some of these split reactions could be an inflation concern, as the article claimed, “the move was coming from an unpopular president at a time when Republicans — and some Democratic economists — have been portraying any expensive social welfare proposal as jet fuel for skyrocketing inflation.” While Democrats, such as Sen. Catherine Cortez Masto (D-NV), worry the relief program may not tailor to the needs of ‘low income’ people according to Biden’s Forgiveness Program. The senator commented, “the debt relief was not targeted enough at low-income Americans or college students entering fields with low pay and desperate need.”